santa clara property tax exemption

Santa Clara Valley Water District. Your total household income for 2021 was below 62292.

County Of Santa Clara Al Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future

Code 27201.

. All homeowners using their property as their primary residence are entitled to a 7000 reduction in the assessed value of their home. County Government Center East Wing 70 W. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

You could be exempt from the tax if you meet all of the following criteria. Hedding StSan Jose CA 95110-1771. Owners must also be given an appropriate notice of rate.

If you own and occupy your home as your principal place of residence you may be eligible for an exemption of up to 7000 off the dwellings assessed value resulting in a property tax savings. You must make some money to be eligible for an exemption. The California Constitution provides a 7000 reduction in the taxable value for a qualifying owner-occupied home.

If you own and occupy your home as your principal place of residence you may be eligible for an exemption of up to 7000 off the dwellings assessed value. 28 rows Cambrian Exemptions Info and Application. The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence.

Available Exemptions Application DeadlinePeriod Renewal Website for Exemption and Application Information. CC 1169 The document must be authorized or required by law to be recorded. Homeowners who meet the.

Assessor Exemptions County Government Center East Wing 5th Floor 70 West Hedding Street San Jose CA 95110 Phone. Exemption Division - 408 299-6460. For More Information Please Contact.

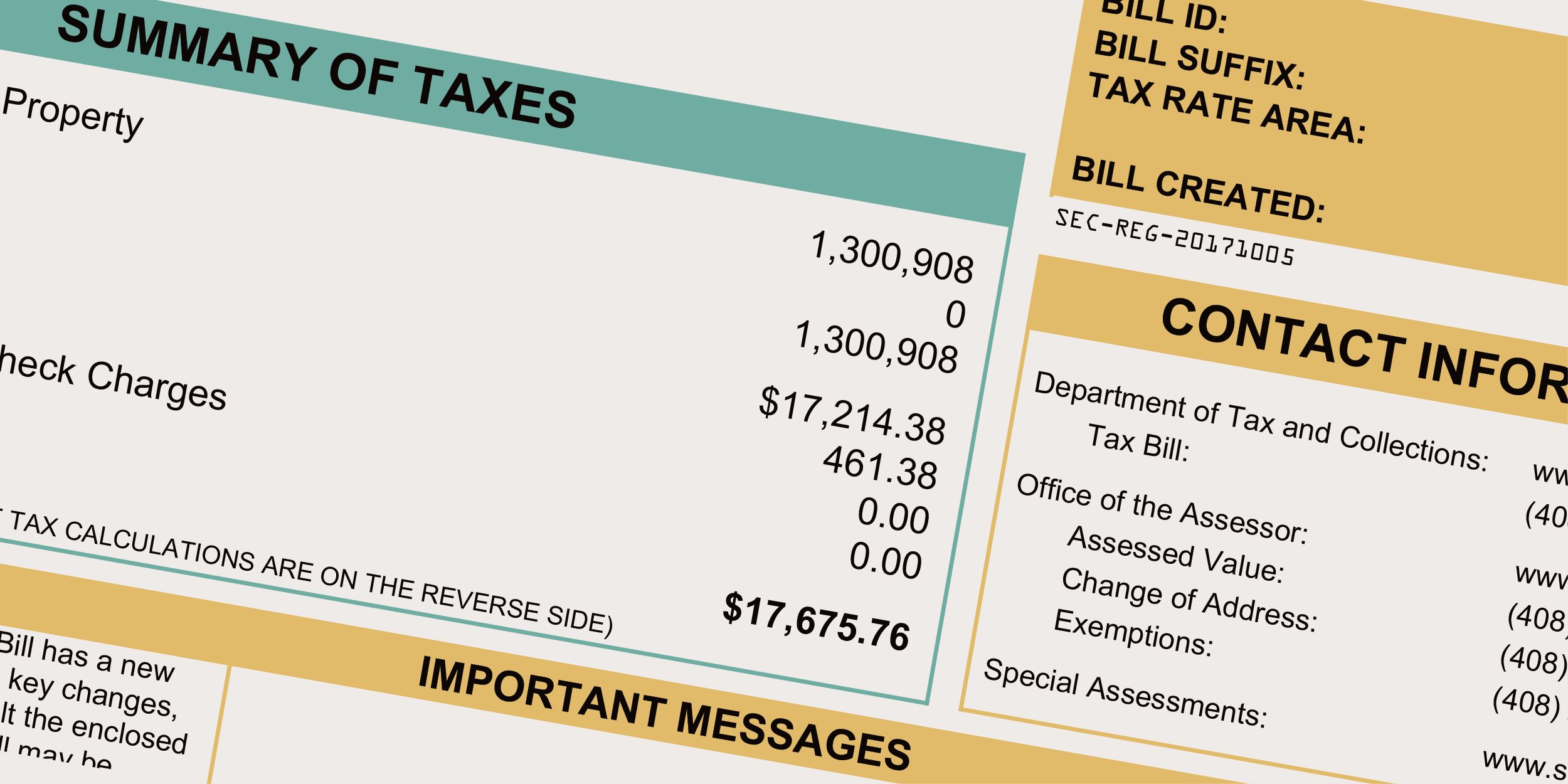

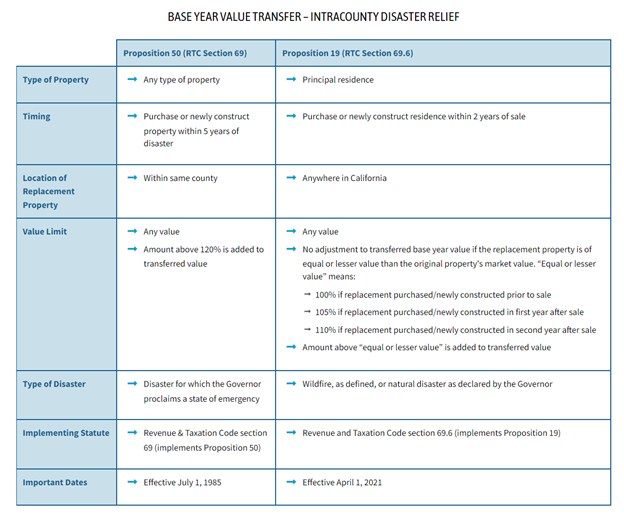

Notices such as these are not authorized nor sent by the County of Santa Clara Department of Tax and Collections. Transfer Assessed Values FAQ Proposition 19 3 58 60 90 How Property Tax System Works. You were born before June 30 1958.

HOMEOWNERS PROPERTY TAX EXEMPTION. Please be advised any notices sent by the Department of Tax and. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis.

23 of 32 school districts in Santa Clara County offer parcel tax exemptions for seniors andor homeowners with disabilities but they are often not publicized well and. Determine how much your real real estate tax payment will be with the increase and any tax exemptions you qualify for. You can qualify for a homestead exemption if your household has a high income.

It limits the property tax rate to 1 of assessed value ad valorem property tax. 31 rows Palo Alto Exemptions Info and Application. The home must have been the principal place of.

Property Tax Exemptions. What appears to be a significant increase in value may only give a. The property must be located in Santa Clara County.

Santa Clara County Supervisors Vote To Endorse Prop 13 Reform Measure News Mountain View Online

Santa Clara County Assessor Staff Wins Fight To Work From Home San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara Property Tax Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Understanding California S Property Taxes

Letter To Kaiser Permanente The County Of Santa Clara Public Health Archives Santa Clara County Board Of Supervisors

Santa Clara County Office Of The Assessor San Jose Ca Facebook

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Santa Clara County Gift Deed Form California Deeds Com

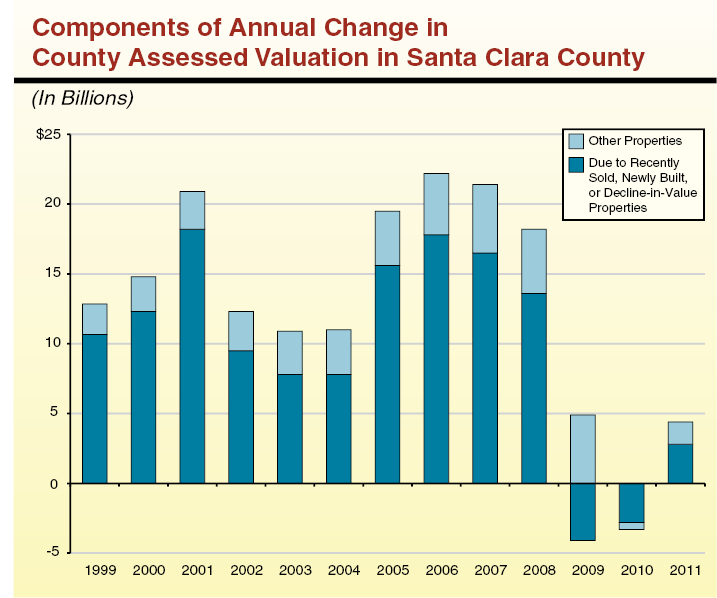

How Has Prop 13 Affected Tax Distribution In Santa Clara County San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Assessor Tells All Employees To Telework Says It S Not Related To Employee Testing Positive For Covid 19 The Silicon Valley Voice

Santa Clara Mayor School District May Have Skirted State Labor Laws Campbell Ca Patch

Low Income Seniors May Apply For Property Tax Exemption Santa Clara Valley Water

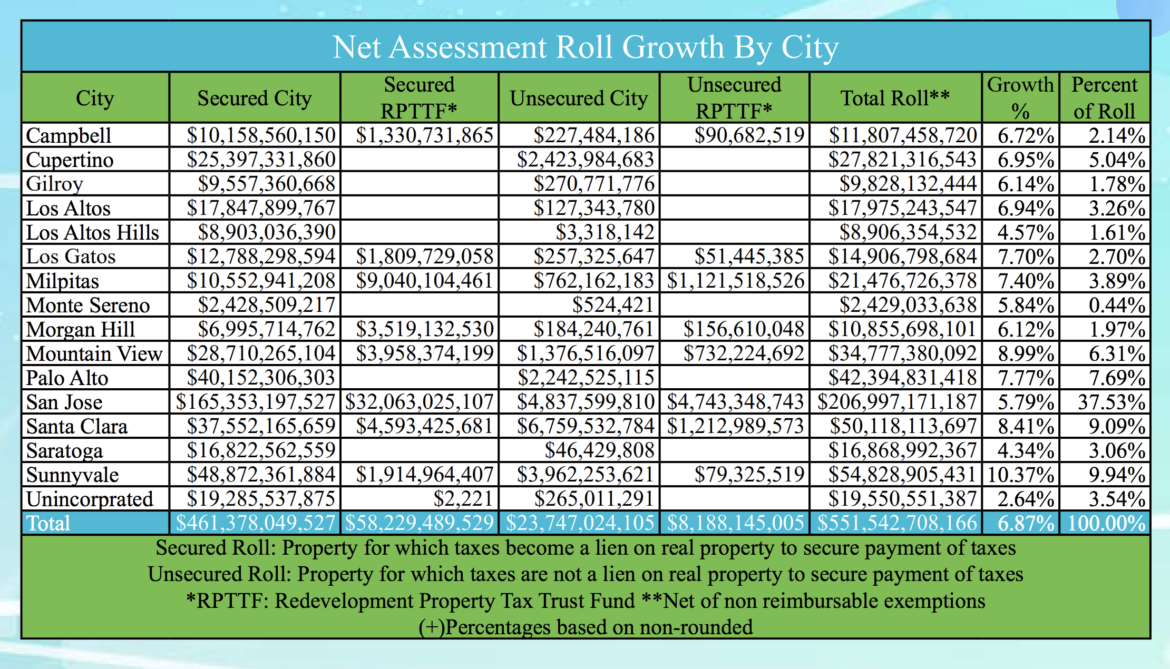

Santa Clara County S 2020 Assessment Roll Culminates Decade Of Economic Growth San Jose Inside

Standards And Services Division